Before we get into everything we’ve accomplished in 2020 – and it’s a lot – I want to talk first about the values and mentality that I know with 100% certainty got us here. Early last year, in a matter of weeks, our worlds were forever changed. Nothing was certain and almost everything was scary. What I saw and felt during that time was one of the most special unspoken commitments I’ve ever witnessed. When I talk about the magic of Central’s culture, I don’t think it can ever be summed up better than that moment when we all made the same choice – to come together to solve, support one another and succeed.

The collective response of our 630 employees was led by a business continuity plan established around a decade ago that included plans for the event of a pandemic. We set this plan into motion well in advance of any federal or state health department mandates and had 85% of our company working from home within two weeks. We were committed to fulfilling our promise to our employees, agents and policyholders, and to do so we had to keep our people safe and our systems and our service top notch. We succeeded on all of those fronts.

Financially, our year was also a resounding success. We began the year in a position of incredible financial strength and ended the year in the same privileged position. We have built our balance sheet to withstand extremes and our conservative investment philosophy proved to be prudent throughout the year’s capital market volatility. I state with great pride that our overall ability to meet our obligations to our employees, agents and policyholders was not affected.

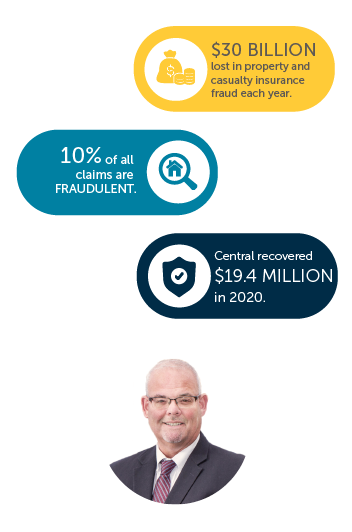

Despite the precariousness of 2020, we remained focused on our primary objective: fulfilling the promise. We stayed on track with our plans to transform our policy system. We continued our plans to realign our team to support our go to market strategy. We made huge strides in building out a world-class anti-fraud unit. We continued to hire new talent eager to join a company that values their contributions. And we created a team devoted to equity and inclusion to help us broaden our understanding and support of one another. That’s an incredible amount of progress and change in any year, not to mention a year of such extraordinary challenge.

Looking ahead, we’re in the fortunate position of being able to build on a foundation that is not only financially strong, but also has a culture of genuine care and extraordinarily high achievement. Together, we’re going to make Central better for the generations that follow us, because changing the world we touch for the better is part of what we do at Central. We’ve done this for 144 years, and we’re only just getting started.